Model REG

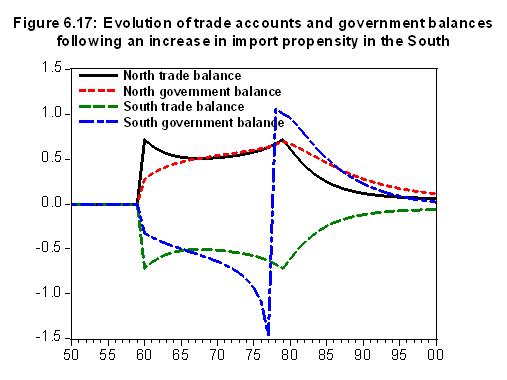

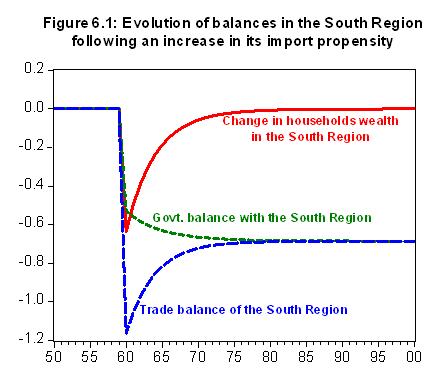

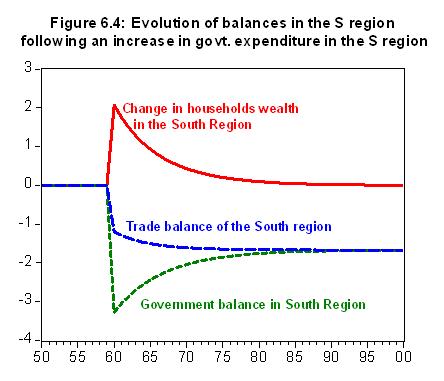

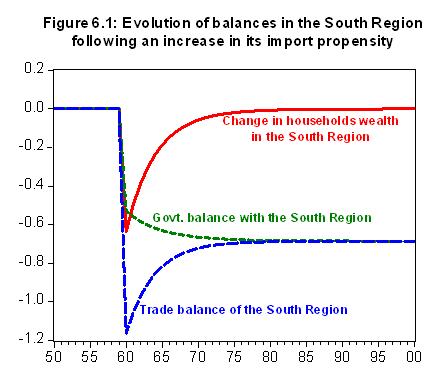

Model REG describes an economy divided in two regions, each with their balance of trade and fiscal balance, sharing a single Central bank.

Download: gl06reg (Eviews 5 to 8) or gl06reg_v4 (Eviews 4.1)

|

|

Table of contents Chapter 6 Notes on EViews version Notation Copyright Comments Guestbook

Model REG - Model OPEN - Model OPENG - Model OPENM - Model OPENM3

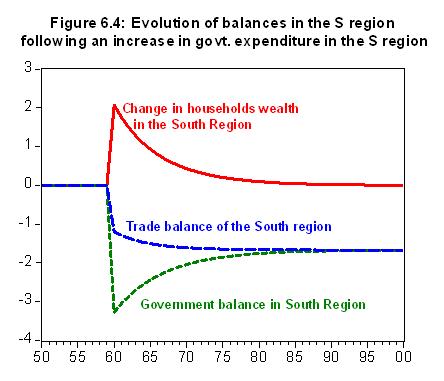

Model REG describes an economy divided in two regions, each with their balance of trade and fiscal balance, sharing a single Central bank.

Download: gl06reg (Eviews 5 to 8) or gl06reg_v4 (Eviews 4.1)

|

|

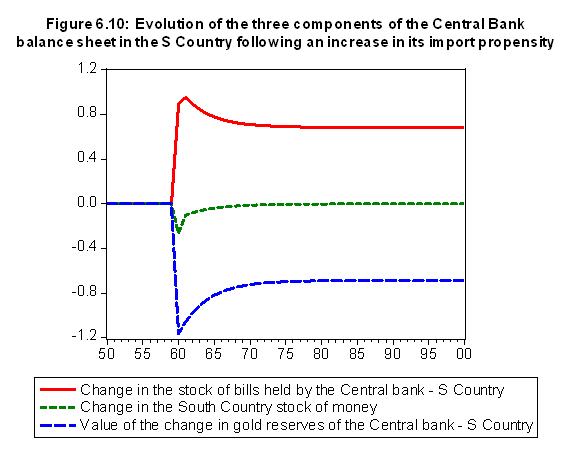

Model OPEN describes two Countries issuing their own currencies, with independent fiscal and monetary policy, which trade under a regime of fixed exchange rates, with no capital mobility

Download: gl06open (Eviews 5 to 8) or gl06open_v4 (Eviews 4.1)

You can use the macros to check that a shock to the import propensity in the South Country has the same effects as in the previous model REG.

|

|

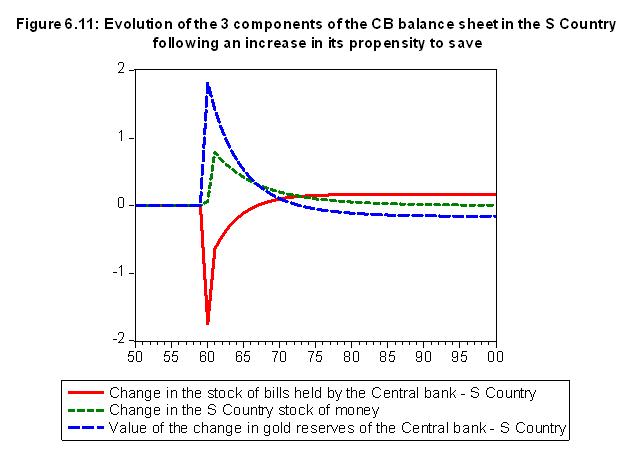

Note that there is a misprint in the book. The label for figure 6.11 on page 201 states that the chart refers to "an increase in the South propensity to consume out of current income", but as the text on page 200 states, and as the macro shows, the charts refers to a decrease in the propensity to consume, or an increase in the propensity to save out of income.

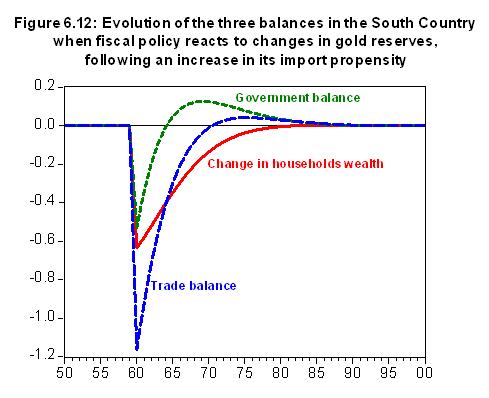

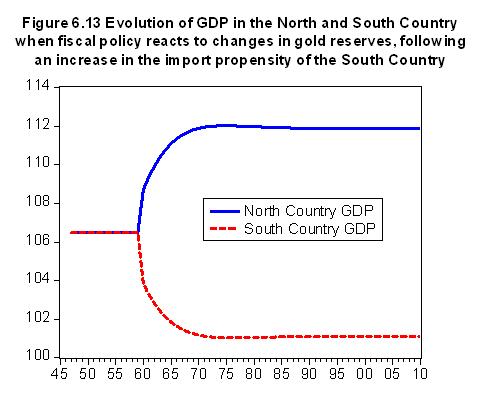

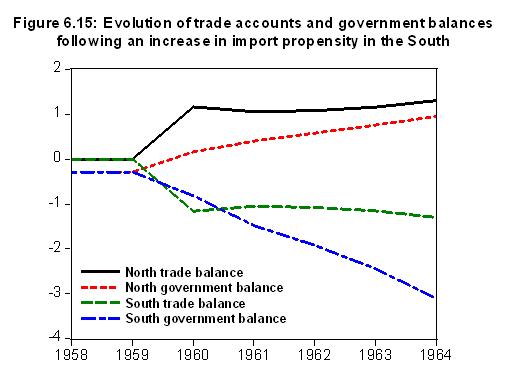

In model OPENG a change in gold reserves held by the Central bank triggers a fiscal policy response.

Download: gl06openg (Eviews 5 to 8) or gl06openg_v4 (Eviews 4.1)

|

|

Note that there is a misprint in the labels in figure 6.12 in the book, on page 204. The label for the trade balance is close to the government balance dotted line, and the label for government balance is closed to the dashed line of the trade balance. Prove it yourself with the Eviews macro.

In model OPENM a change in gold reserves held by the Central bank affects interest rates, while government expenditure

in both countries is again discretionary as in model OPEN.

In the book, appendix 6.2, the equations for model OPENM should have the percent change in gold reserves

as a determinant of interest rates, rather than the absolute change in gold reserves.

Download: gl06openm (Eviews 5 to 8) or gl06openm_v4 (Eviews 4.1)

Model OPENM3 modifies model OPENM to allow interest rates to affect the propensity to consume out of current income.

In the book, appendix 6.2, the equations for model OPENM3 should have the percent change in gold reserves

as a determinant of interest rates, rather than the absolute change in gold reserves.

The interest rate in equations 6.O.35 and 6.O.37 has been lagged one period to reduce the degree of simultaneity of the model.

Download: gl06openm3 (Eviews 5 to 8) or gl06openm3_v4 (Eviews 4.1)